Become A Philanthropist

Unlock Several New Layers Of Income, Impact, and Influence By Channeling Your Time, Skills, Gifts, and Wealth Towards Humanitarian and Public Benefits Causes

We Help Entrepreneurs and Investors Unlock The Power of The Tax-Exempt And Public Benefit Structure

Philanthropy is an alternating operating system - not a loophole.

In 1889, Andrew Carnegie published the Gospel of Wealth in which he asserted that any funds that are in excess or surplus of one's personal needs should be treated as a trust fund that benefits society.

This concept was indoctrinated into the Tax Code in 1917, thanks to the relentless efforts of Senator Hollis, who persuaded Congress to pass the Charitable Tax Deduction (found in Schedule A today).

His argument was simple:

A pre-tax deduction would incentivize more donations, and ultimately, up to 100% of the donations would reach the intended charity versus only 5, 10%, or 15% reaching the intended charity if it were to go through the government bureaucratic process - collected through taxes.

For over 100 years, this framework has been the operating model for successful entrepreneurs and investors - and today - in it's most evolved manner, this framework can be utilized by anyone who is looking to have a deeper impact in the world, advance causes they care about, and gain generations worth of tax and estate preservation benefits for doing a part of the government's work.

Strategic Philanthropy Is A Way Of Life, Not A Loophole.

It's an operating model that aligns and connects:

business, personal, and philanthropic goals.

public, corporate, and private funding for aligned goals.

law, tax, finance, and philanthropic systems.

the gaps caused by mismatched business, estate, and tax goals.

governments, corporations, businesses, and individuals.

This is the operating formula deployed by the ultra wealthy and influential figures in society.

Members who believe their time, talent, and treasure can benefit their family and society at the same time.

Strategic philanthropy is formalized by incorporating nonprofits and foundations into the existing business, estate, and tax strategies - that's what the "traditional family office" model deployed by the wealthy.

This is our domain of expertise - the strategic and tactical fusion of different goals, entities, funding sources, professionals, and concepts to maximize your income, impact, and influence across several generations. Maximize the full potential of the tax code by redirecting your time, talent, and treasure to serve humanity.

Here are some examples:

Our institute facilitates the legal, tax, and financial architecture, strategy, and compliance.

Examples of corporate, foundation, and government organizations fueling social causes.

Examples of nonprofits and foundations deployed across 100s of industries

Examples of magazines, publications, and technology companies created and commercialized

Examples of inventors, entrepreneurs, investors, business owners, experts, and thought leaders from 100+ industries

Strategies featured across

Press Play To Watch The Videos

TEDx Talk on Strategic Philanthropy Leveraging Public Nonprofits

Strategic Philanthropy Through Private Foundations

The Strategic Advantages of Integrating Nonprofits & Foundations

Integrating a nonprofit or private foundation isn’t about charity - it’s about control, efficiency, and leverage.

Here’s what it unlocks:

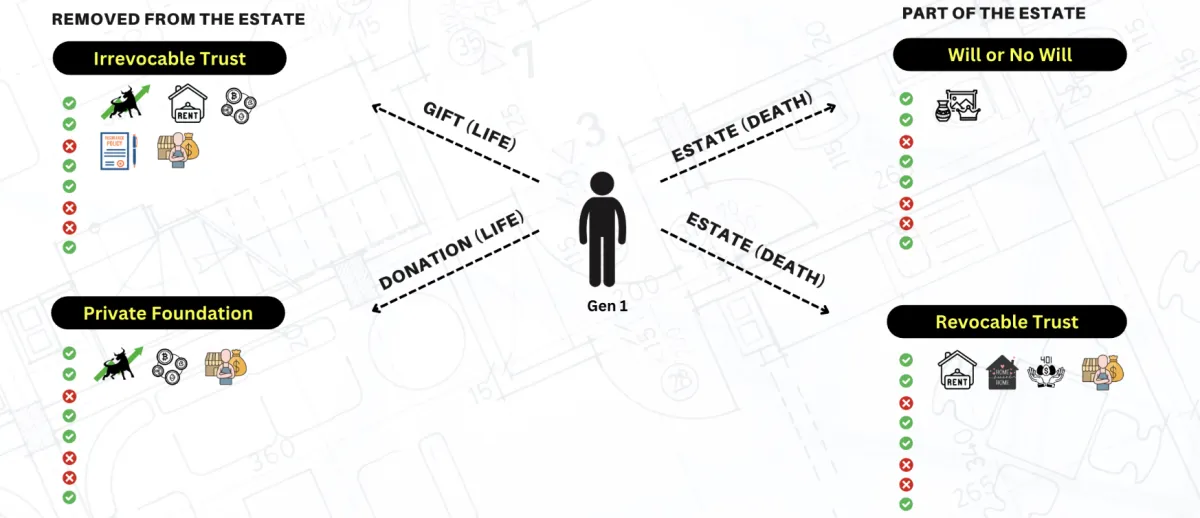

Estate Reduction Tool

Shrink your taxable estate by donating assets into structures you influence.Asset Protection Layer

Move IP, assets, and capital out of exposed entities and into protected vehicles.Risk Reduction Strategy

Reduce personal and business risk by removing assets from your personal balance sheet.Lifetime Income Tax Reduction

Lower income taxes year after year — not just once.5-Year Deduction Carryforwards

Unused deductions don’t disappear — they roll forward.Capital Gains & Depreciation Recapture Relief

Donate appreciated assets and reduce capital gains and recapture taxes.Probate Cost Elimination

Assets donated don’t go through probate — no courts, delays, or public exposure.Capital & Grant Access

Unlock funding sources unavailable to individuals or for-profit businesses.Reputation & Credibility Lift

Build goodwill, authority, and trust while advancing real missions.Flexible Contribution Model

Contribute time, talent, capital, IP, and expertise — not just cash.Gift Tax Workarounds

Bypass the rigid limits of wills, revocable trusts, and traditional gifting strategies.

Why the Wealthiest Families Do This

There’s a reason the world’s most powerful families hold, control, and manage wealth through nonprofits and foundations — especially in the U.S.

They’re not giving wealth away.

They’re repositioning it.

A Parallel Legal & Tax System - Hidden in Plain Sight

This isn’t a loophole.

It’s an entirely separate business, legal, tax, and estate system - one most entrepreneurs and investors are never shown.

When done strategically:

It doesn’t cost you.

It doesn’t weaken your business.

It doesn’t reduce your control.

It's the exact opposite:

It reduces several layers of taxes

It elevates the reputation of your business

It enhances control of income, assets, and IP

The Reality: Most Advisors Don't Cover This

Most legal, tax, finance, and insurance advisors are focused on implementing their unique solution to your overall wealth generation and preservation plans.

While you are alive:

The business lawyer focuses on business structuring.

The estate lawyers focuses on estate documents

The IP lawyer focuses on IP filings and registration

The accountant focuses on filing and reporting old data

The financial advisor focuses on AUM and ignores everything all other "finances"

The insurance agent specializes in policies and won't touch anything else

The realtor focuses on getting the property bought or sold and their commission

After your death:

Finally - the probate lawyer, if required, is hired to piece together all the above transactions - while trying to deal with probate judges, lawyers, creditors, the tax man, and the banks, financial institutions, realtors, accountants, and auctioneers at the same time.

The statistics show that upwards of 80% of all "deaths" end in probate court, despite having various estate and succession documents - that statistic should not surprise you - especially if NONE of the advisors have ever coordinated and aligned their strategies.

What We Do

We focus on the "big picture" and connect the independent pieces of the puzzle to spot and fix the leaks, gaps, and traps that can dilute and destroy your wealth, wisdom, and values. Those are the gaps that philanthropic business and estate planning is designed to fix.

We help entrepreneurs and investors integrate nonprofits and foundations as strategic tools for:

Business growth

Estate protection

Investment strategy

Tax optimization

Legacy creation

Not someday.

Now.

This isn’t philanthropy as sacrifice.

It’s philanthropy as strategy.

The Role Of Public Nonprofits & Private Foundations

One is structured to receive and deploy fuel to educate, innovate, and transact with the public.

The other is structured to convert excess income & assets into impact investments, grants, and donations.

Structured together - these entities complete the puzzle.

Public nonprofit:

Active model

Operate a public nonprofit like a business:

Offer goods and services like a business (certain limits exist)

Secure grants from corporations, individuals, and government agencies

Board members are family and independent parties

Offer programs and services

Receive grants & donations

Get compensation for your work

Operate as a stand-alone company or in alignment with your business ventures

Stand out as an educator, speaker, innovator, early tech adopter, and impact investor empowering society

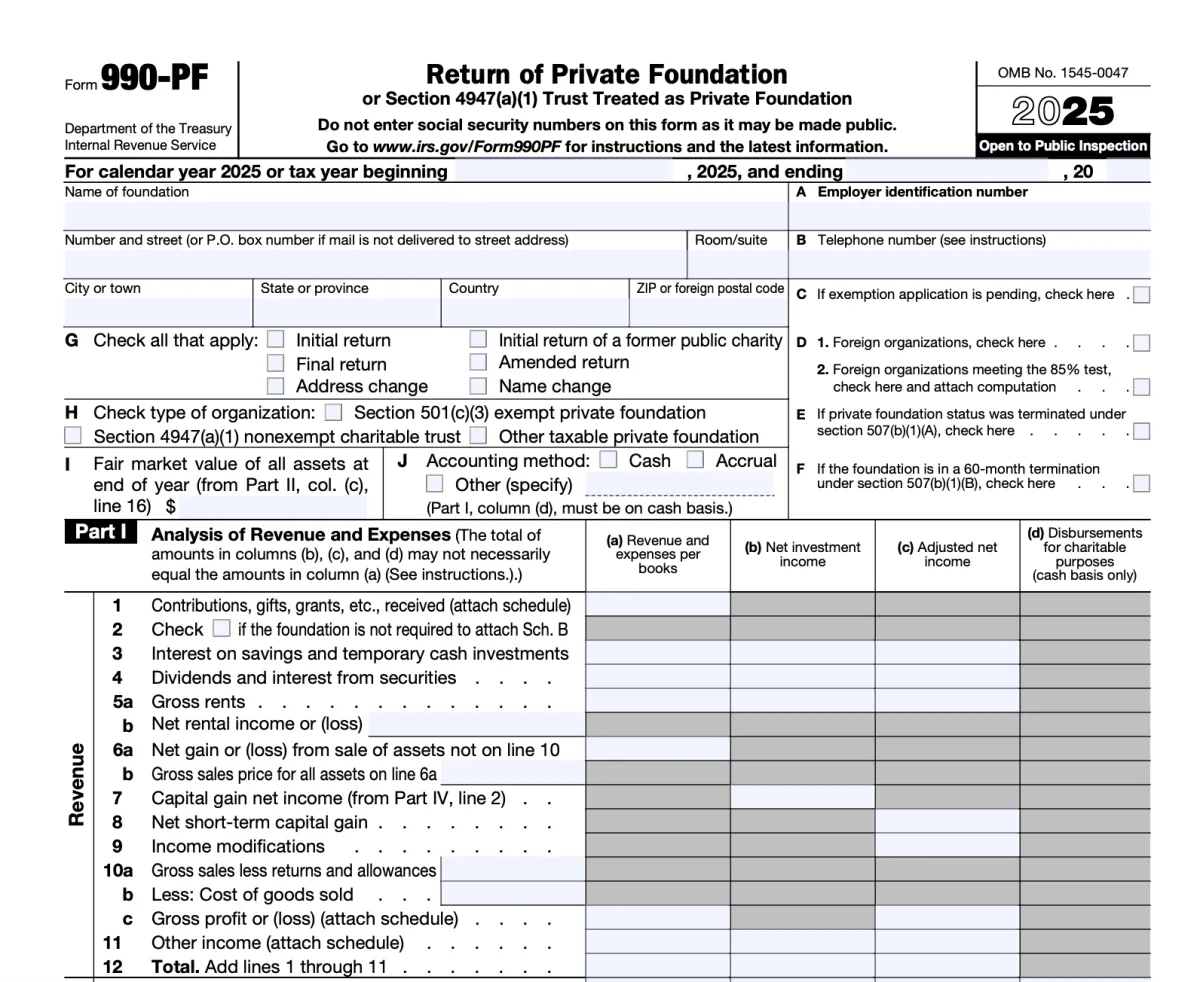

Passive foundation:

Passive model

Operate a private foundation like a charitable investment fund:

Invests in a diverse range of assets - real estate, stock, shares, crypto, etc.

Funded by one family or a corporation

Multiple family members can donate to one foundation

Assets are removed from the estate and bypass probate

Family controls all decisions - no independent board required

Kids and grandkids take board seats, generation after gen.

Reasonable compensation for investment and charity allowed

Integrates with businesses, wills, trusts, and tax strategies

Both Together:

Your Wildcard

Think of your nonprofit entities as the ultimate "wildcard" that you and your family have at your disposal:

Reduce 30-50% of taxable income every single year

Break the 1031-exchange cycle and beat capital gains and recaptured depreciation on exits

Control the donated funds and reinvest them into diverse assets - in a tax-free setting

Convert "taxable dollars" into "donations and grants"

Preserve wealth for generations to come and prevent heirs or even ex-spouses from diluting your wealth

BECOME A PHILANTHROPIST™

Get An In-depth Evaluation Covering Business, Estate, Tax, and Investment Strategies Under An Alternate Set of Lenses - As A Philanthropist and Impact Investor.

Fill out the assessment form below >>

Schedule A Complimentary "Philanthropic" Call

© 2024 Become A Philanthropist™, Philanthropic Estate Planning™ copyrighted intellectual property of Become A Philanthropist LLC. All rights reserved. No legal, tax, financial, or compliance advice provided. All information and content on this site is intended for educational and entertainment purposes only. No attorney-client relationship formed by contacting us or filling out a form or scheduling a call with our team.